During his campaign last year, Donald Trump promised the Americans that he would enter into a new era of prosperity.

Now two months after his presidency, he draws a little different.

He has warned that it would be difficult to reduce prices and the audience should be ready for a “little disorder” before being able to return wealth to the United States.

At the same time, analysts say that the chances of contraction are increasing, indicating its policies.

Is Trump about to run the recession in the world’s largest economy?

Markets fall and high recession risk

In the United States, the recession is defined as a long and wide decrease in economic activity, which is usually characterized by a jump in unemployment and a decrease in entry.

In recent days, a group of economic analysts have warned of the high risk of such a scenario.

The JP Morgan report put the chance of recession by 40 %, an increase of 30 % at the beginning of the year, warning that the American policy was “tending to grow”, while Mark Zandy, the chief economist in MOODY analyzes, has increased by 15 % to 35 %, indicating the definitions.

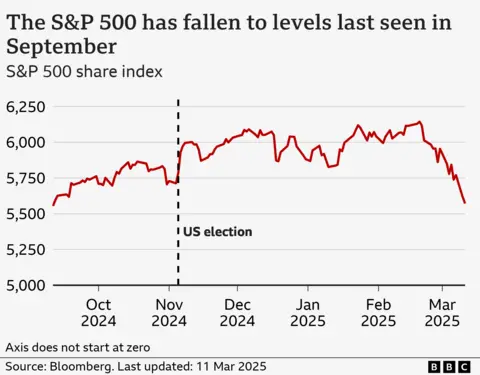

The expectations came in the role of S&P 500, which follows 500 of the largest companies in the United States. It has now decreased to its lowest level since September in a sign of fears about the future.

The disturbances in the market are partially driven by concerns about new taxes on imports, which are called customs tariffs, which Trump has made since he took office.

It has set products from the three largest commercial partners in America with new duties, and has widespread a large scale in the moves that analysts believe will increase prices and limit growth.

However, the latest official inflation figures in the United States showed a rate of price cooling in February.

The Ministry of Labor said that prices increased by 2.8 % in 12 months to February, a decrease from 3 % in January.

However, Trump and his economic advisers warn the public against preparing for some economic pain, while it seems to be refused Market fears – a marked change of his first term, when he often cited the stock market as a measure of its success.

“There will always be changes and modifications,” he said last week.

The situation increased the investor’s concerns about his plans.

Goldman Sachs last week raised stagnation from 15 % to 20 %, saying that they have seen politics changes as “the main risks” of the economy. But note that the White House still has “the option to retreat if the negative risks begin to look more dangerous.”

“If the White House remains committed to its policies even in the face of much worse data, the risk of recession will rise more,” the company analysts warned.

Definitions, uncertainty and slow growth

For many companies, the biggest question marks are the customs tariff, which provokes the costs of American companies by setting taxes on imports. Since Trump reveals tariff plans, many companies are now facing lower profit margins, while they are launched in investments and employment while trying to know the shape of the future.

Investors also feel anxious about the major discounts of government workforce and government spending.

Brian Gardner, head of Washington’s policy strategy at the Investment Bank, said companies and investors believe that Trump is intended to define as a negotiating tool.

“But what the President and the Council of Ministers indicate is actually a bigger deal. It is a restructuring of the American economy,” he said. “This is what was driving markets in the past two weeks.”

The American economy was already subjected to slow, partially designed by the central bank, which kept interest rates higher to try to cool the activity and achieve price stability.

In recent weeks, some data indicate faster.

Retail sales decreased in February, and the confidence – which emerged after Trump was elected in many investigative studies of consumers and companies -, and companies warning including major airlines and retailers such as Wall Mart and target, and manufacturers of decline.

Some analysts are concerned that the decrease in the stock market may lead to an increase in spending, especially among high -income families.

This can provide great success for the American economy, which is driven by consumer spending and increasingly dependent on those richer families, as low -income families face pressure from inflation.

The President of the US Central Bank, Jerome Powell, made assurances in a speech last week, noting that the feelings were not a good indication of behavior in recent years.

“Despite high levels of uncertainty, the American economy is still in a good place,” he said.

But the American economy is currently linked to the rest of the world, as Kathleen Brooks, director of research at XTB.

“The fact that the customs tariff can be disrupted that at the same time there were signs that the American economy was weakening anyway … it really supplies stagnation.”

Stock markets in mature technology for correction

The discomfort in the stock market does not revolve around Trump.

Investors have already increased about the possibility of correction, after great gains over the past two years, driven by acute operation in technology shares fueled by investor optimism about artificial intelligence (AI).

For example, Chipmaker Nvidia has seen the share prices of less than $ 15 at the beginning of 2023 to nearly $ 150 in November last year.

This type of rise has sparked a discussion about the “artificial intelligence bubble” – with investors at a state of maximum alert to obtain signs on the explosion of IT, which will have a significant impact on the stock market, regardless of dynamics in the wider economy.

Now, with the views of the American economy that dires, optimism about artificial intelligence increases.

Technology analyst Jane Monster from Deepwateer Asset Management this week on social media that his optimism “took a step back” with a stagnation “tangible” during the past month.

“The bottom line is that if we enter the recession, it will be very difficult for the trading of artificial intelligence to continue,” he said.

https://ichef.bbci.co.uk/news/1024/branded_news/7d96/live/faf1a6c0-ff42-11ef-8c3d-b7dcc7510cb1.jpg